ev charger tax credit california

Federal tax credit available for 30 of the cost of installing a home or commercial EV charger up to 1000 for home charging. Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in California.

What Are The Ev Charger Levels

Q1-Q3 2021 EXCEL FILE.

. Ford Is About to Start Building Affordable EVs Before jumping into whether the 2021 Ford Mustang Mach-E is eligible for EV tax credits lets talk about what these credits actually are. Up to 7500 Back for Driving an EV. When connected to a Level 3 DC Fast Charger you can go from 20 to 80 in approximately 36 mins.

Federal tax credit for 30 of total station and installation costs up to. Department of Energy EVs and plug-in hybrids purchased new after 2010 may be eligible for the federal EV tax creditThe credit maxes out at. The federal tax credit is a potential future tax savings.

Oregon has an EVC tax credit for 50 of the project cost up to. Many states also offer additional rebates and incentives for electric vehicle customers up to 2500 in certain cases. Most owners will be well served choosing a 40-amp charger that can deliver 96 kW to the EV.

Incentives can help reduce the upfront cost. DC Fast Charger Reliability Is Critical For Mainstream Adoption of Electric Vehicles May 24 2022. EV SALES BY STATE.

EV Companies Publicly Traded in the US Table. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. There is also a US.

For example the New York State Department of Taxation and Finance offers an income tax credit of 50 of the cost of EV charging infrastructure up to 5000 through the alternative fuels and electric vehicle recharging property credit. Just purchase or lease and apply with your taxes. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure.

Mainstream Hyundai XCient fuel-cell 18-wheelers in California. Its a bridge technology good through 2030 or 2040. The credit varies depending on the vehicle make and battery size.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. This incentive covers 30 of the cost with a maximum credit of. JuiceBox Smart EV Charger.

Its applicable through December 31 2020 for home chargers bought and installed in 2018 2019 or 2020. How The Federal Electric Vehicle EV Tax Credit Works. According to the US.

Cable 95 Questions Answers. A 48-amp charger can charge slightly faster at 115 kW but requires a. A battery electric vehicle.

Get a federal tax credit of up to 7500 for purchasing an all-electric or plug-in hybrid vehicle. For example the EV infrastructure federal tax credit for an EVC in 2016 is 30 up to 1000 for residential consumers and up to 30000 for businesses. Despite its robust EV numbers the lack of charging is apparent just 1638 chargers averaging over 18 EVs per charger in the state.

Home Flex Electric Vehicle EV Charger 16 to 50 Amp 240-Volt Wi-Fi NEMA 14-50 Plug IndoorOutdoor 23 ft. Get the details on the credit available for the vehicle youre considering. The amount of your tax savings will depend on your individual tax circumstances.

Get the latest local Detroit and Michigan breaking news and analysis sports and scores photos video and more from The Detroit News. Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in California. Charging at home and on-the-go is easy.

Q3 2021 CALIFORNIA EV CHARGING UTILIZATION REPORT. Including the renewed U. 5 Each MX-30 also comes with a Level 1 120V charging cable that can be plugged into any household outlet as well as a connector thats compatible with most public charging stations.

Some states provide EVC and battery-only electric vehicle BEV incentives. Lectron 240V 40 Amp Level 2 EV Charger. Simply charge up and.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Clean Cities Coalitions California is. Luckily New Jersey is in a great location in the Northeast.

ChargePoint Home Flex WiFi Enabled EV Charger. Be sure to file the form for this credit with your taxes.

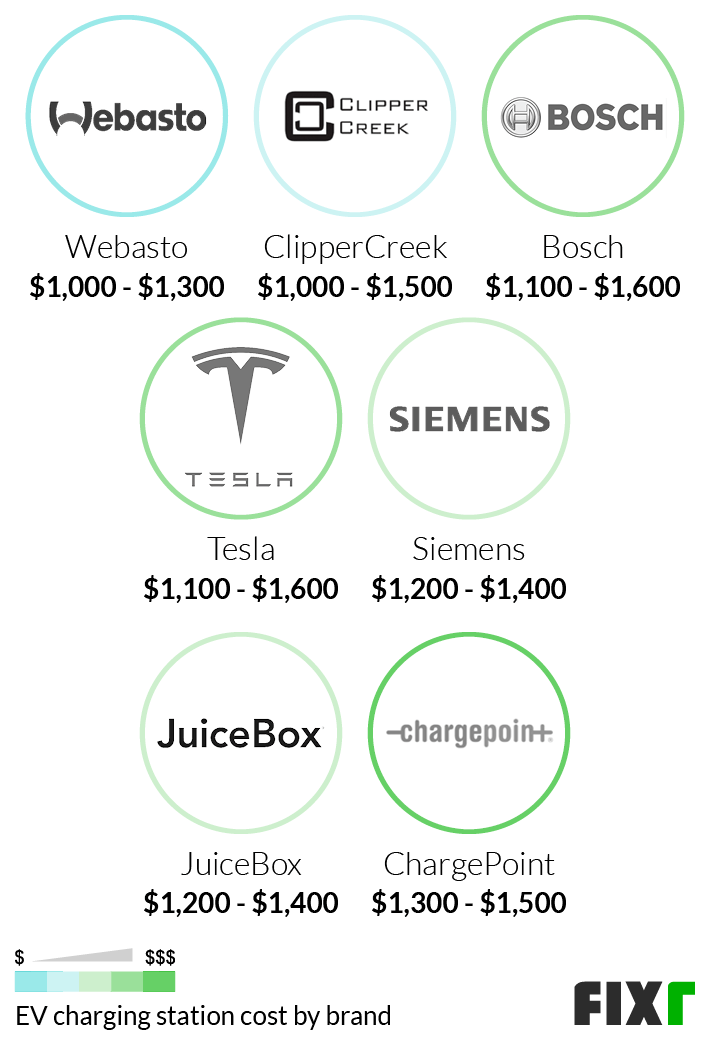

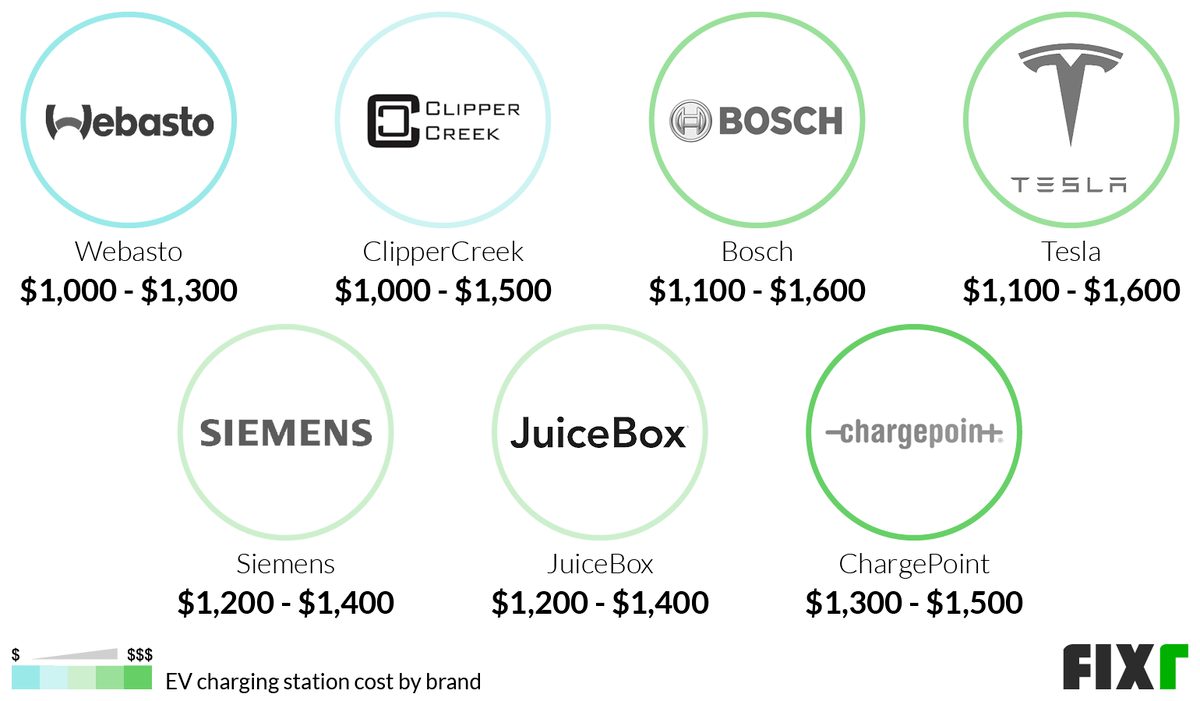

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

Billions Of In Incentives For Ev Charging In 2022 Ev Charging Stations Ev Charging Incentive

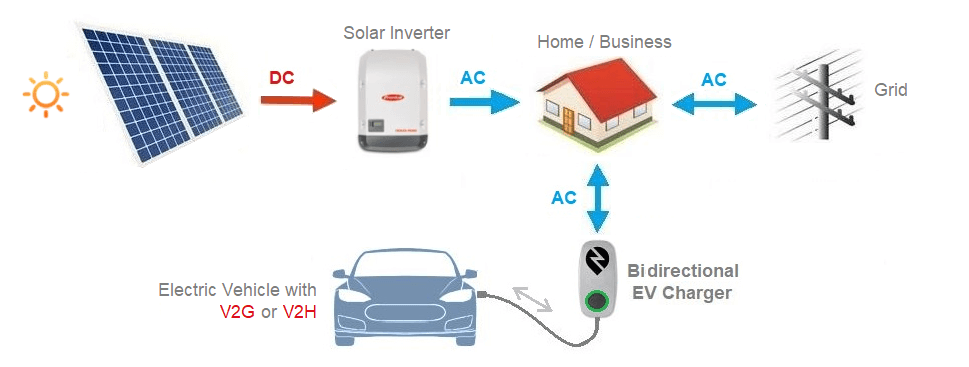

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

State Electric Vehicle Charging Guide

Chargepoint Home Flex Electric Vehicle Ev Charger 16 To 50 Amp 240 Volt Wi Fi Enabled Nema 6 50 Plug Indoor Outdoor 23 Ft Cable Cph50 Nema6 50 L23

Powercharge Energy Platinum Level 2 Commercial Ev Charger

Rebates And Tax Credits For Electric Vehicle Charging Stations

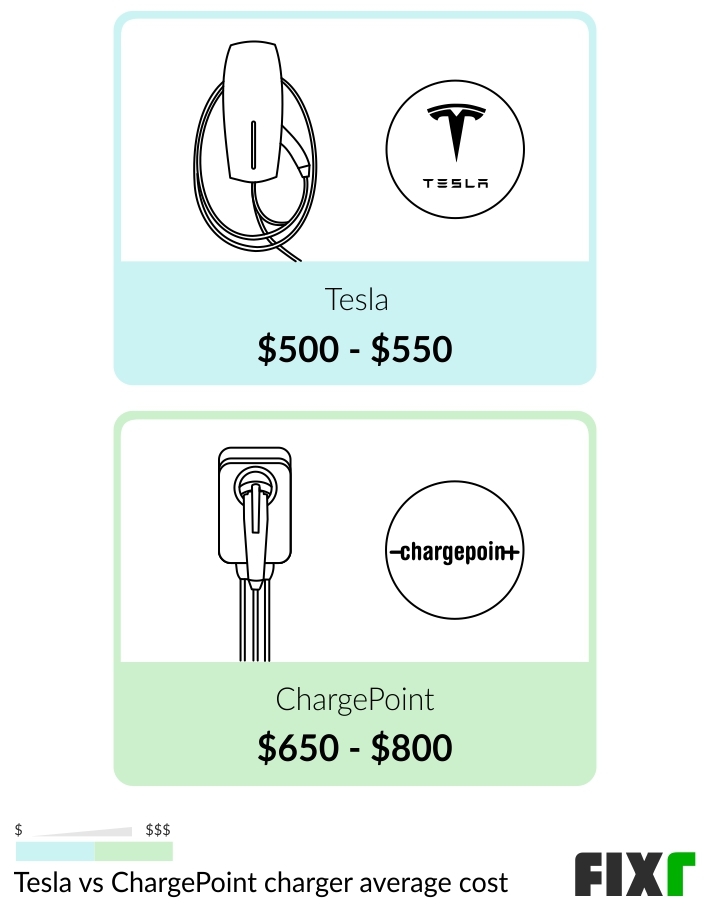

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

Delta Ev Charger 30 Amp 25ft Charging Station

Bosch Ev200 Series 16 Amp 12 Cord Ev Charging Station El 51245

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Beyond Bid Getting Ev Charging Plugged Into Reconciliation Third Way

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

How To Claim An Electric Vehicle Tax Credit Enel X

Track Electricity Use And Cut Costs 100 Remote No Cost No Equipment Sunistics

Need A Home Ev Charging Station Check Out Your Local Autozone